Health insurance represents a major line item in an organization’s financial statements and is often perceived as one of the most challenging costs to control. However, for many mid-sized and larger companies, the actual insurance cost is a minor component of their healthcare expenditures.

Since the implementation of the Patient Protection and Affordable Care Act (ACA) in 2010, the percentage of employees in self-insured plans has ranged between 58 and 60 percent, according to the Employee Benefit Research Institute. This data suggests that a majority of U.S. employers are self-funding their employee healthcare costs, rather than relying solely on purchased health insurance plans.

In a self-funded health plan, employers typically secure stop-loss insurance to mitigate financial risks from significant health claims attributable to an individual (specific coverage) and an accumulation of claims (aggregate coverage). Depending on the deductibles for specific and aggregate claims, stop-loss insurance may represent only 25% to 33% of total healthcare spending. If an employer participates in a group captive insurance program, the percentage of actual risk transfer can be less than 10%.

Instead of focusing solely on health insurance costs, employers should examine the total cost of care. This metric is commonly used by healthcare providers to assess the cost-effectiveness of their services but is equally relevant for employers providing healthcare benefits. The practice of providing health insurance benefits to employees dates back to the Stabilization Act of 1942, which, due to wage controls, led employers to offer health benefits as a non-wage compensation. Today, offering health insurance is essential for U.S. employers to attract and retain talent, despite the rising costs and complexities involved. While the majority of US employers self-funding employee healthcare, few are using the total cost of care metric to measure and manage these costs. The total cost of care for an employer encompasses several components:

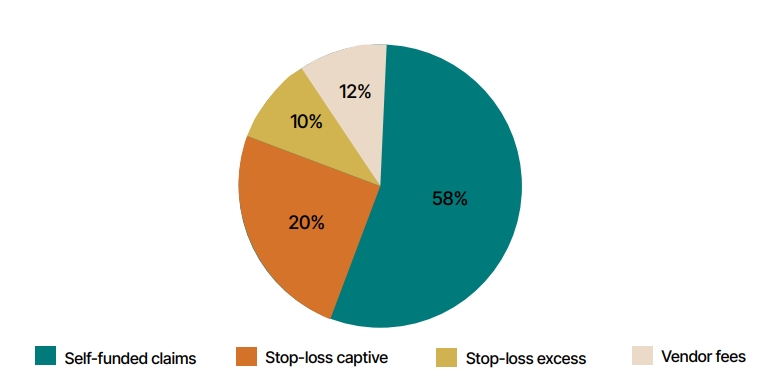

- Self-funded claims: These are often the largest expense in employer healthcare programs, making up 55-65% of total costs, even with moderate stop-loss insurance retentions.

- Administrative and vendor fees: Managing a self-funded plan involves significant administrative overhead and requires specialized vendors for managing medical and pharmacy benefits. These fees, which can rival the costs of risk transfer, usually constitute 10-15% of total cost of care.

- Stop-loss insurance: Providing both specific and aggregate coverage, this insurance kicks in at about 125% of anticipated claims under the self-funded arrangement. Despite its volatility, group captive arrangements can provide stability and access to cost containment strategies, making up 20-30% of the total cost of care.

Long-Term Perspective

Shifting from a focus on annual health insurance expenses to a comprehensive view of the total cost of employee care represents not only a metric change but also a strategic shift. Health insurance is typically purchased annually, emphasizing short-term financial planning and risk management.

However, adopting a total cost of care metric allows employers to acknowledge and measure the long-term financial responsibilities of employee healthcare. This metric also facilitates the assessment of various cost containment strategies that can impact long-term expenses.

TCOR Comparisons

Chief Financial Officers and risk managers might find parallels between the total cost of care and the Total Cost of Risk (TCOR), a concept developed in 1966 by Douglas Barlow at Massey-Ferguson. TCOR includes insurance premiums, self-insurance costs, risk control expenditures, and administrative costs, mirroring the components of the total cost of care for employers. This similarity provides a familiar framework for organizations to integrate total cost of care metrics into their strategic financial planning.