In the third installment of our series exploring the COST advantage of group captives in managing an employer’s total cost of care, we delve into the “S” for Stability. Medical stop loss coverage can exhibit significant volatility, with health insurance claims spanning from high frequency and low severity to low frequency and high severity.

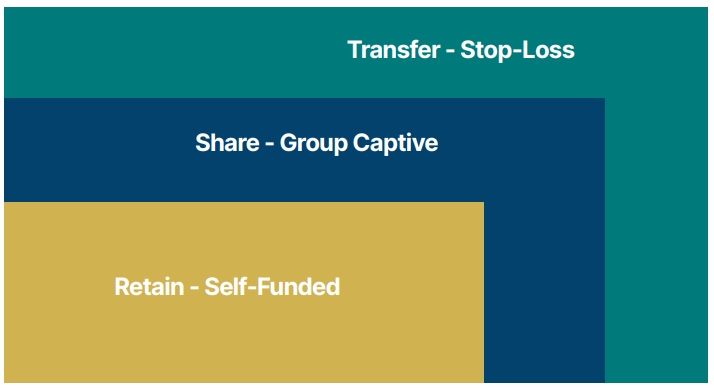

The inherent unpredictability of catastrophic claims makes them suitable for insurance coverage, while it is more cost effective to self-fund more predictable, frequent claims avoiding the additional administrative expenses and profit included in insurance premiums. The positioning of stop loss insurance is illustrated in the claims distribution below.

Stop loss insurance is designed to shield against catastrophic claims. These high severity, low frequency claims are inherently volatile, leading to fluctuating experiences from year to year. Large, infrequent claims can result in uneven “lumpy” claims experiences, impacting the pricing and availability of stop loss insurance. Premiums may spike following bad years, and despite good years, they seldom decrease equivalently, if at all. This can lead to a cycle of inflated pricing over several years due to the volatility in claims.

A group captive offers a practical solution to manage this volatility. By pooling stop loss claims across multiple employers, the negative impacts of a bad year for any single employer are mitigated by better years from others. This collective approach helps smooth out the effects on renewal pricing of stop loss coverage for all participants. Within the captive, an employer facing a challenging year may not receive distributions, but benefits from the overall stability provided by the captive’s shared risk and collective purchasing of excess coverage.

Diagram Explanation: The graphic illustrates how group captives categorize claims into three segments: retain (predictable claims), share (stop loss claims within a certain threshold), and transfer (catastrophic claims). The captive acts as a buffer, spreading some costs in the shared layer and collectively purchasing protection for true catastrophic events in the transfer layer.

Impact of Cost Containment: As discussed in our previous article on Community, group captives enhance cost containment strategies to manage healthcare costs. Effective cost containment can shift the overall distribution of healthcare costs towards more predictable, manageable events.

For instance, direct primary care models, which operate on a fixed monthly fee for access to primary care services, can significantly impact routine medical costs, the high frequency, low severity claims. But what impact does this have on less frequent higher cost claims. Greater access to primary care often results in earlier diagnosis and treatment, potentially reducing the frequency and severity of claims that escalate to catastrophic levels. Even if you cannot convince a stop loss carrier of the direct impact on catastrophic claims to merit a decrement on the stop loss rate, being part of a group captive allows for the recapture of savings from these shifts in cost distribution, benefiting the entire cost curve.

For more information on joining or starting a group captive, please contact info@mslcaptives.com. Our forthcoming article will focus on Trust and the importance of transparency within group captive structures.